How to Calculate the BreakEven Point for a Business

Still Going Strong on Calculus. When Mathematica 1.0 was released in 1988, it was a "wow" that, yes, now one could routinely do integrals symbolically by computer. And it wasn't long before we got to the point—first with indefinite integrals, and later with definite integrals—where what's now the Wolfram Language could do integrals better than any human.

How to Calculate My Business' Break Even Point Trailhead Accounting

The breakeven point ( breakeven price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two.

How To Use A Break Even Point Calculator For Business Profitability

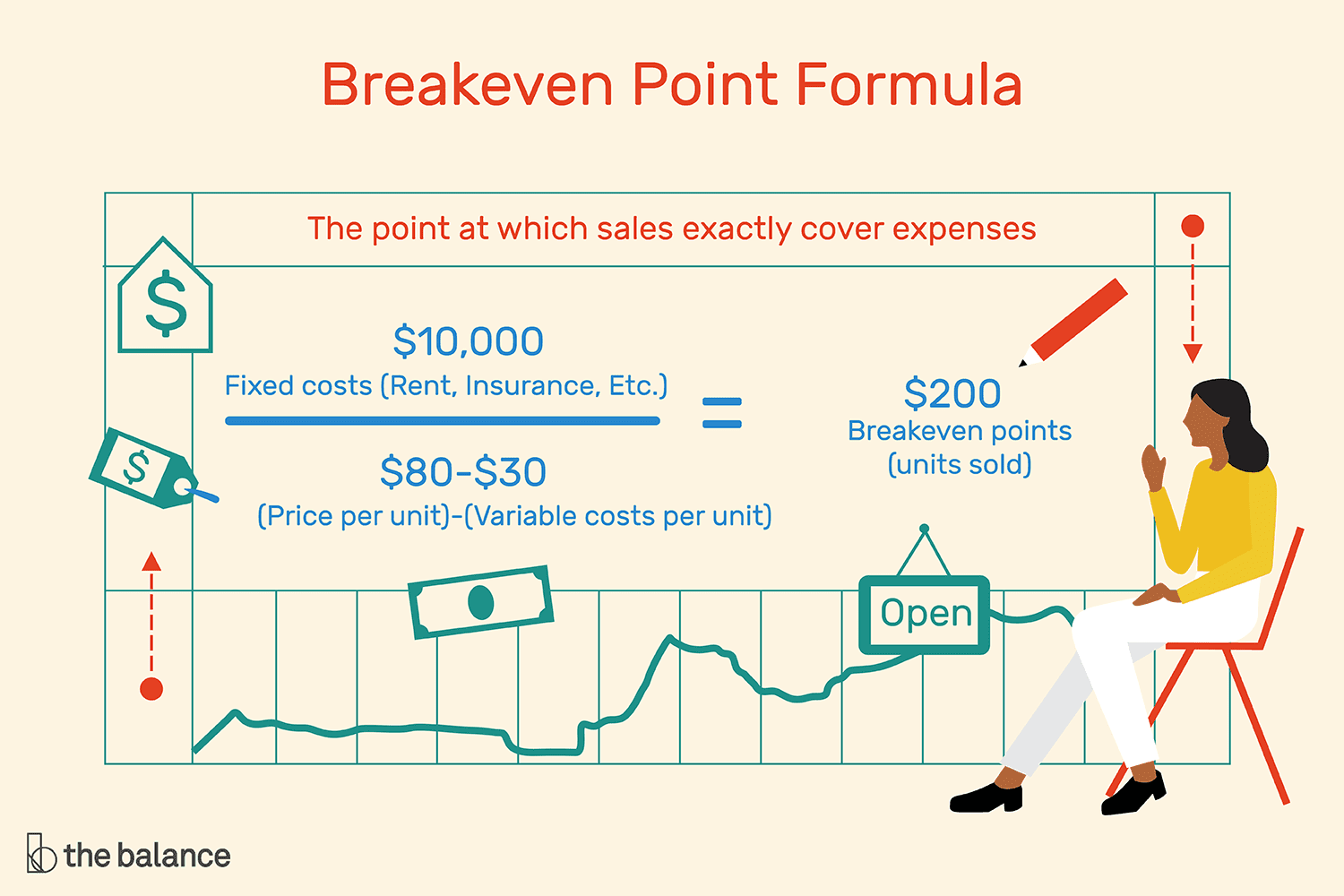

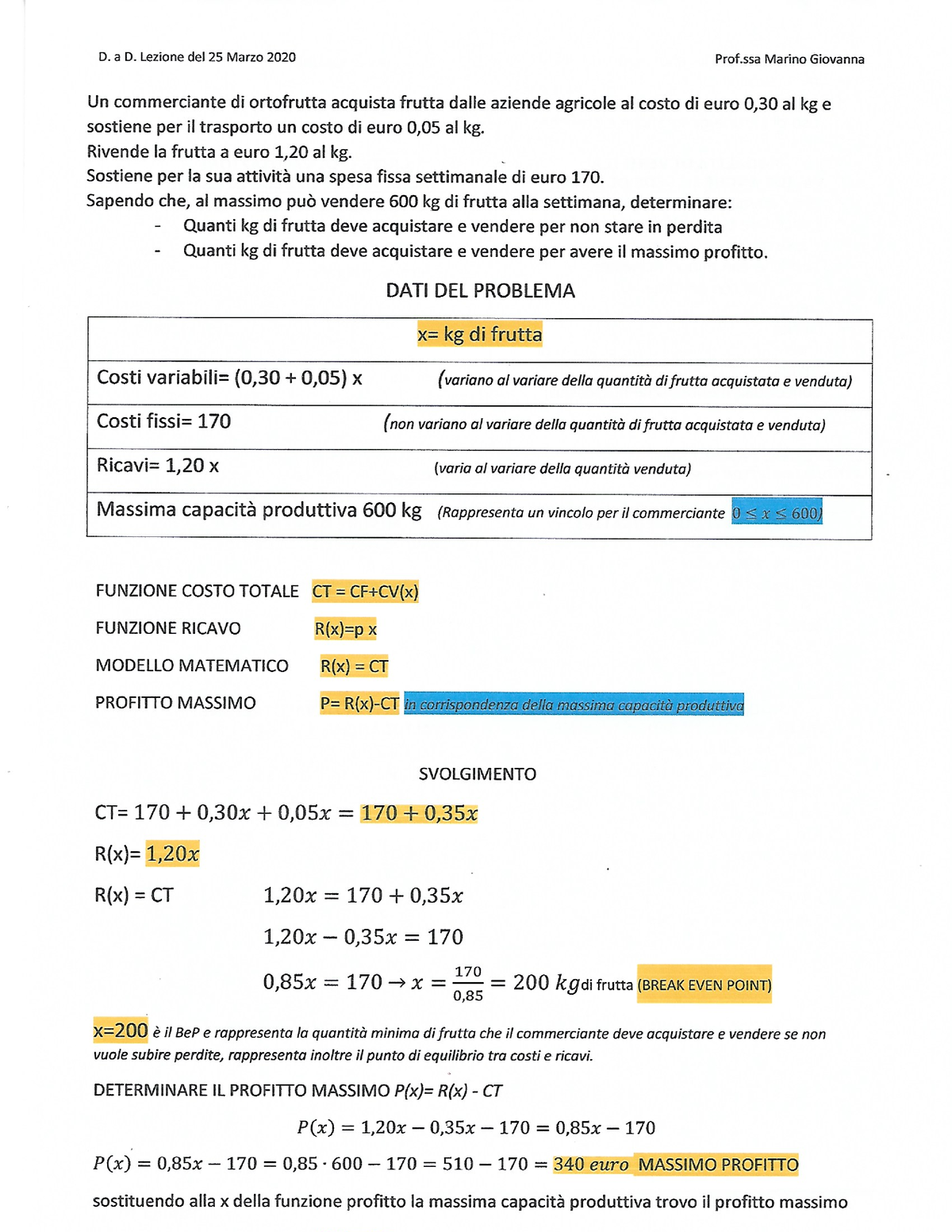

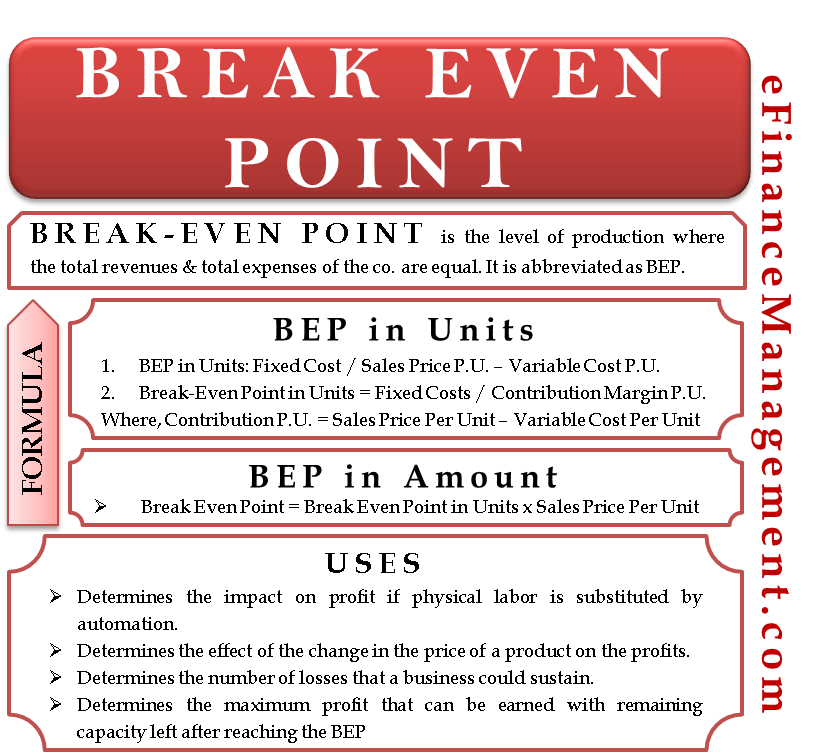

Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit. So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00.

How to Calculate the BreakEven Point for Your Business Paychex

What is break-even point? In economy, the break even point is when you don't make a profit and you don't lose money either. In other words, your revenue or income is equal to your expenses. Say R = revenue and C = cost R = C Example #1: It costs a publishing company 50,000 dollars to make books.

How to calculate Break Even Point (BEP)? Project Management Small

Income Statement. Retained Earnings Formula. Gross Profit Margin Formula. To calculate the break-even point in units use the formula: Break-Even point (units) = Fixed Costs ÷ (Sales price per unit - Variable costs per unit) or in sales dollars using the formula: Break-Even point (sales dollars) = Fixed Costs ÷ Contribution Margin.

Break Even Point (BEP) Formula and Units Calculation

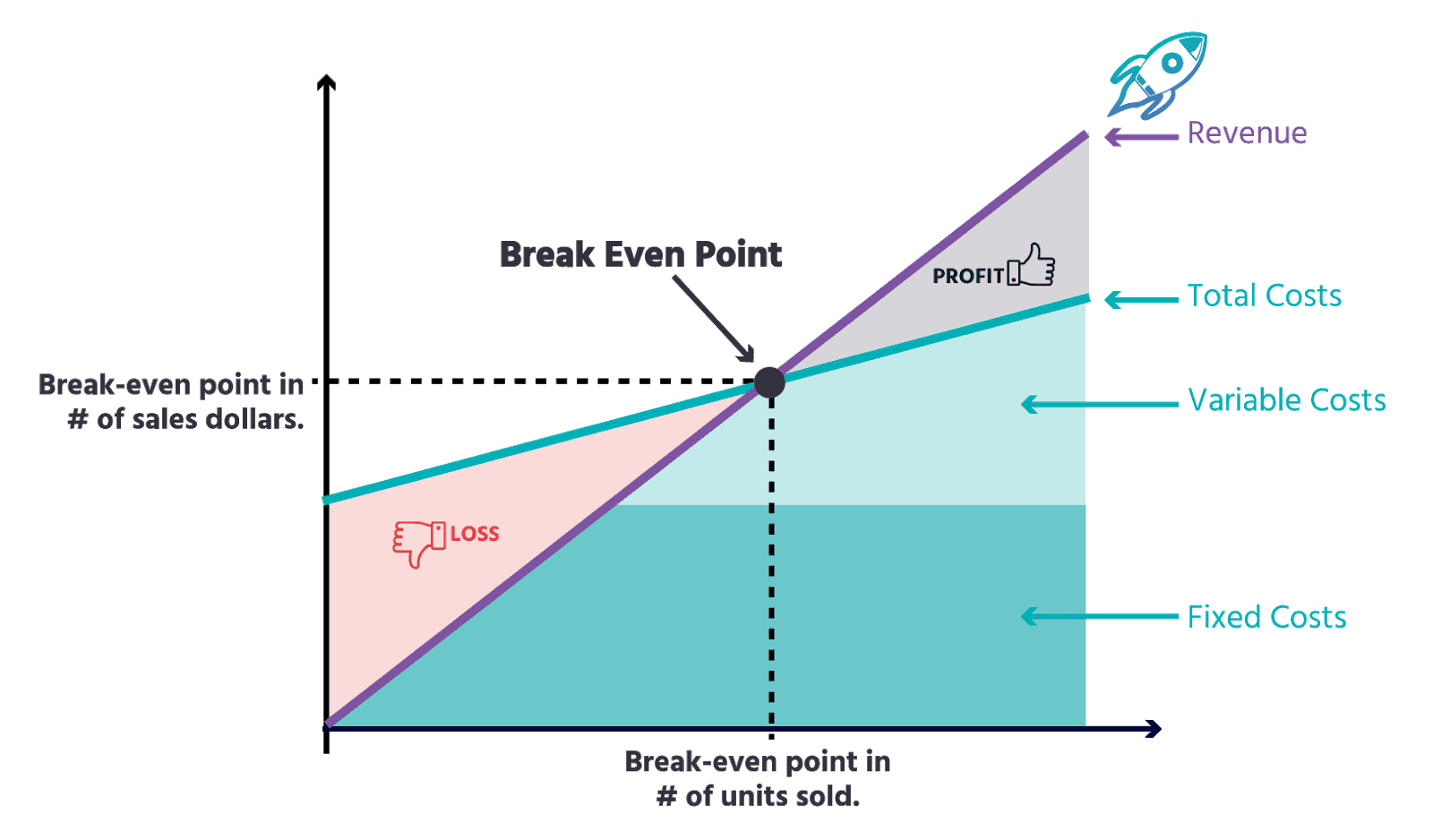

At the break-even point fixed sunk costs and marginal costs equal the marginal revenue. The yellow area gives the total loss for a number of units produced and sold which is less than the number of units needed to break even. The green area gives total profits accumulated after passing that critical point.;

break even point in "Enciclopedia della Matematica"

A Quick Guide to Breakeven Analysis by Amy Gallo July 02, 2014 In a world of Excel spreadsheets and online tools, we take a lot of calculations for granted. Take breakeven analysis. You've.

Break Even Point (Formula, Example) How to Calculate Break Even Point

Break Even Calculator The break-even point is the number of units that you must sell in order to make a profit of zero. You can use this calculator to determine the number of units required to break even. Our online tool makes break-even analysis simple and easy.

Break EVEN Point Matematica Finanziaria Studocu

Il Break even point: cos'è e come si calcola.Il Break even point o punto di pareggio, rappresenta il punto di equilibrio, è la quantità di ricavi necessari a.

The Importance of Knowing Your BreakEven Point Insight CA Limited

We find that the infidelities are commensurate in these two experiments. Using dynamic circuits with feedforward operations, we encode a two-qubit error-suppressed input magic state with a logical.

Free Vector Break even point graph

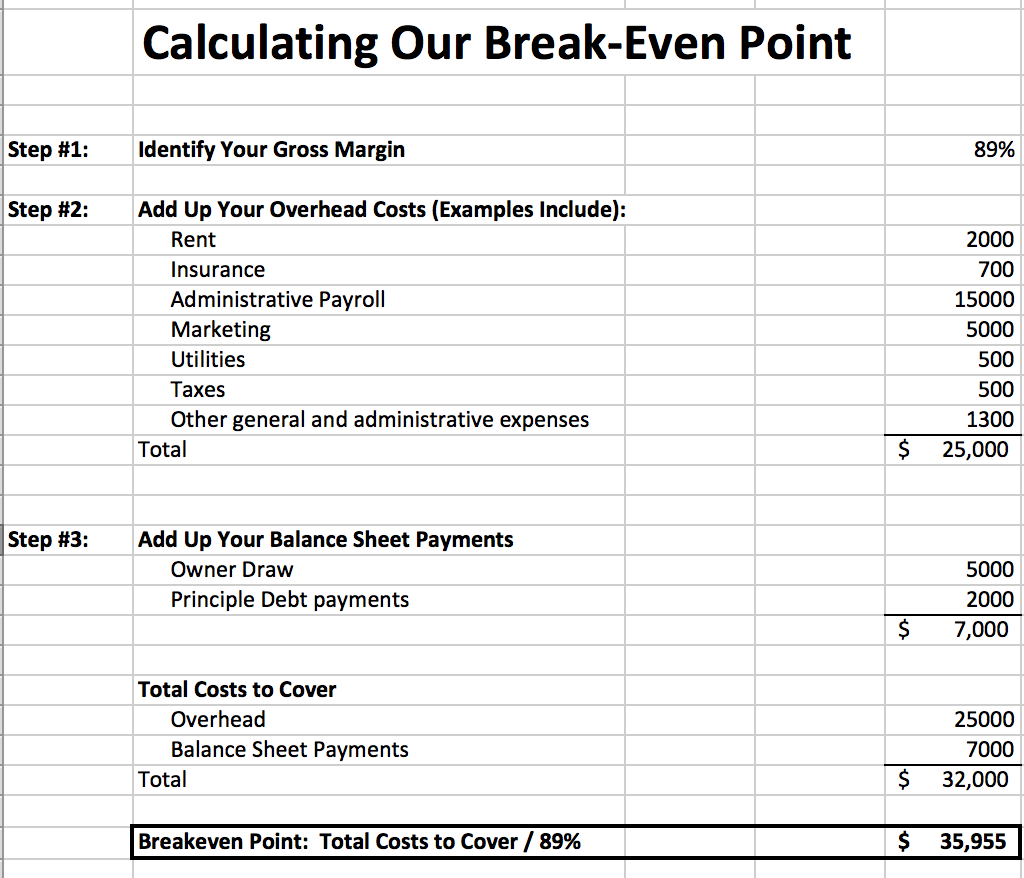

Break-even analysis is the effort of comparing income from sales to the fixed costs of doing business. The analysis seeks to identify how much in sales will be required to cover all fixed costs.

BreakEvenPoint Onpulson Wirtschaftslexikon

1 I just uploaded a sample Excel spreadsheet that mirrors the one I actually use. Based off of that photo of the sample spreadsheet, what would my break even point be? Aside from shipping costs, I have no other expenses at all. The blank spaces represent products that have not sold yet.

Break Even Point Definition, Formula, Example, Uses, etc.

The break-even point, or break-even quantity, is the number of units a company needs to sell in order to earn $0 and lose $0. The definition of the break-even point is that it is the quantity of.

Wayne Lockwood How to Calculate Your Business’s Break Even Point

Break-Even Point Definition. In accounting, economics, and business, the break-even point is the point at which cost equals revenue (indicating that there is neither profit nor loss). At this point in time, all expenses have been accounted for, so the product, investment, or business begins to generate profit. The concept of "breaking even.

Breakeven Point Meaning, Advantages, Disadvantages and Examples

Il break even point definisce il punto in cui i costi totali (fissi + variabili) per una produzione o un prodotto sono equivalenti al fatturato complessivo. Break even point: le basi

Break Even Point (BEP) Formula + Calculator

To calculate your company's breakeven point, use the following formula: Fixed Costs ÷ (Price - Variable Costs) = Breakeven Point in Units. In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Note that in this formula, fixed costs are stated as a total of all.